Heloc amortization period

I generally do not advocate getting a home equity line of credit see my home equity loan spreadsheet but if you already have one the Line of Credit Calculator spreadsheet below may help. Mortgages for homes valued at less than 1 million with a down payment of less than 20 of the purchase price in Canada have a maximum amortization period of 25 years.

Equity Repayment Home Equity Lending Third Federal

Download a free ARM calculator for Excel that estimates the monthly payments and amortization schedule for an adjustable rate mortgageThis spreadsheet is one of the only ARM calculators that allows you to also include additional payments.

. A HELOC is a different type of second mortgage because like a home equity loan it is secured by the equity in your home but it operates differently than a more traditional home equity loan. Your HELOC acts more like a credit card while still being secured by your home and you use and repay as needed but you have a cap on the credit account. The initial period can be three years 31 five years 51 seven years 71 or ten years 101.

They require a set monthly payments for a fixed period of time where a borrower is lent a set amount of money upfront and then pays back a specific amount each month for the remainder of the loan. 15000 to 750000 up to 1 million for properties in California. The mortgage amortization period is how long it will take you to pay off your mortgage.

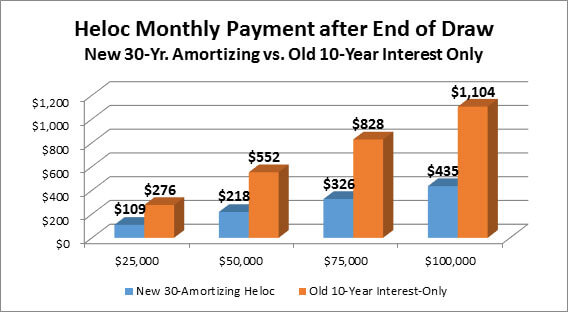

Loan amortization is the process of scheduling out a fixed-rate loan into equal payments. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing insurance portfolio management finance and accounting personal investment and. If you compared this with a traditional cash-out refinance of a first mortgage which would typically amortize over 30 years the HELOC payment will be meaningfully higher.

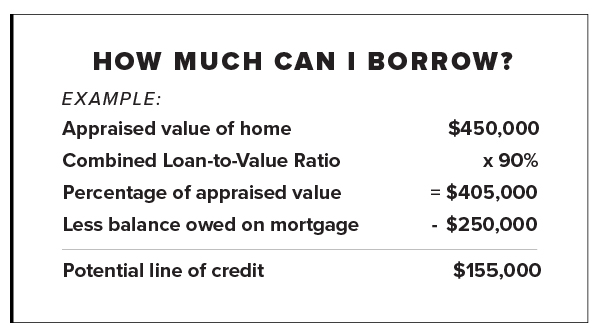

For this hybrid product the HELOC portion is 65 while the amortizing mortgage portion is 15. The appraised home value is 1250000. Lenders typically loan up to 80 LTV though lenders vary how much they are willing to loan based on broader market conditions the credit score of the borrower.

HELOC Payment Calculator For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments. One year ARMs used to be the standard but the market has now produced ARMs called hybrids which combine a longer fixed period with an adjustable period. Regardless of the price of your home if you make a down payment of at least 20 you are able to access a mortgage that.

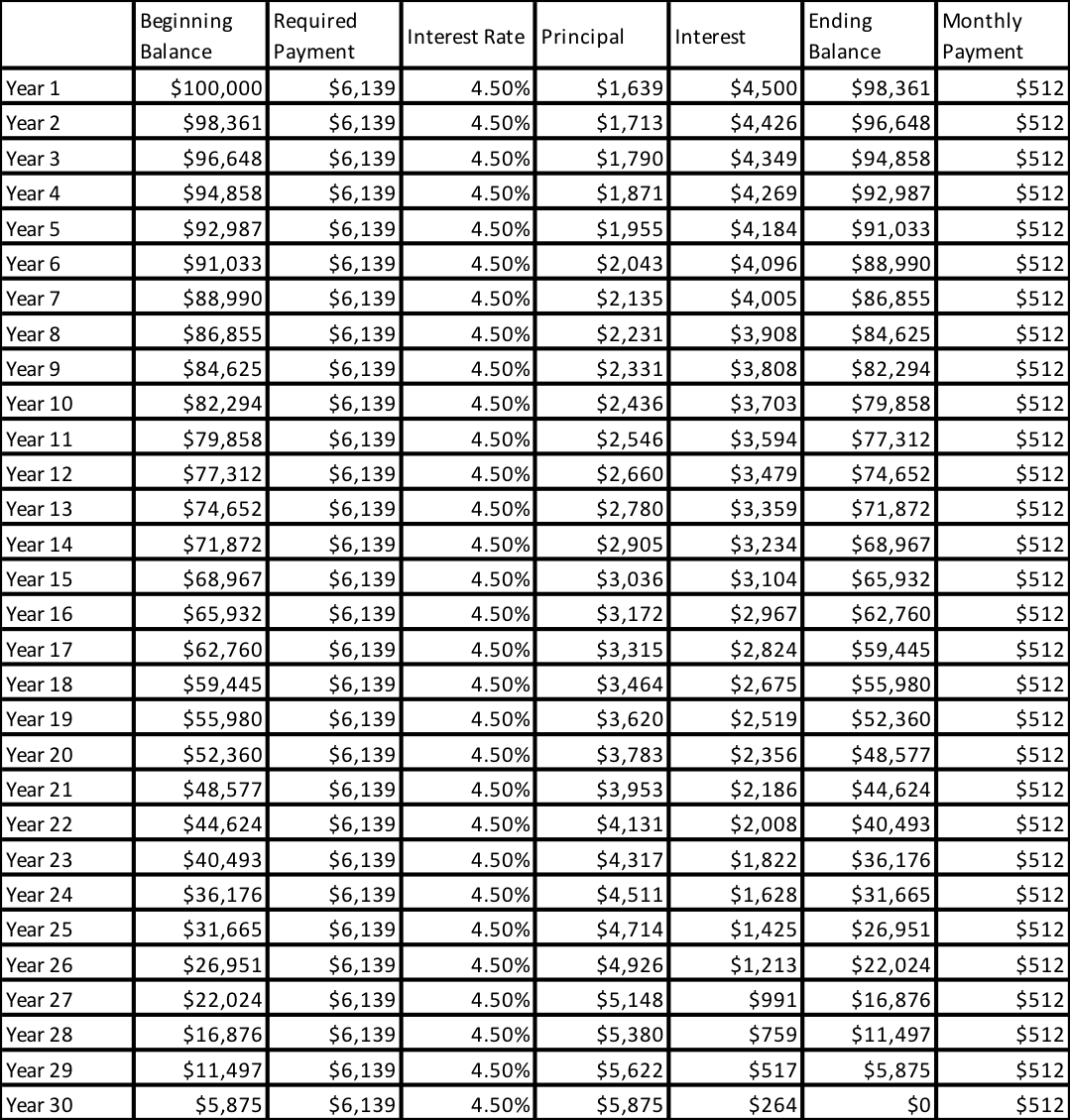

The HELOC repayment is structured in two phases. The longer the amortization period the lower your monthly payment. In addition to calculating your total interest paid the student loan calculator above shows you how much of your monthly payment goes toward interest.

Following the draw periods expiration the repayment period begins. The HELOC amortization schedule is printable and you can export it to excel or as a pdf file. A portion of each installment covers interest and the remaining portion goes toward the loan principal.

Download a free Home Equity Line of Credit Calculator to help you estimate payments needed to pay off your debt. The rate will change annually according to the market after the initial period. Thats because the longer you spread out your payments the less it will cost you each month simply because theres more.

Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. At the end of the draw period youll need to repay the full amount borrowed. Much like a credit card a HELOC is a revolving credit line that you pay down and you only pay interest on the portion of the line you use.

Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables. 500 discount on 3rd party fees 250 - 3800 estimated for loans up to 400000 and maximum combined loan-to-value of 80 with an initial draw of 10000 at closing. But while a HELOC lets you draw on.

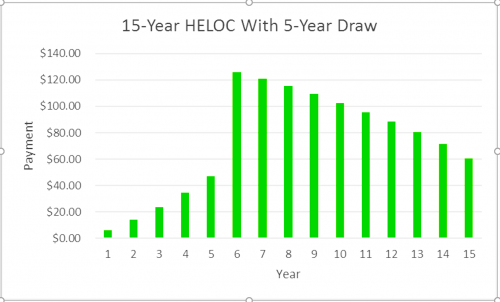

Most draw periods are between 5 and 25 years. As noted in the interest-only payment section above many HELOCs will require you to pay a fully amortized payment and this amortization period is often 20 years. The most common mortgage term in Canada is five years while the most common amortization period.

Since the homeowner is applying for a hybrid HELOC the maximum amount available for the line of credit is 80 of the home value. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home. You can withdraw HELOC funds at any time during the draw period defined by your lender.

It is much more powerful and flexible than most HELOC calculators that you. The draw period is. HELOCs may have a minimum monthly payment due similar to a credit card or you may need to pay off the accrued interest each month.

If you are. Below is the calculation for Homeowner As maximum HELOC credit limit. During your repayment period youll no longer have access to funds via the HELOC and will be required to make monthly payments until the loan is fully paid off.

Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance. Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for.

6 Primary residence HELOC has no credit union closing cost annual fee or prepayment penalty. Generally HELOCs come with a repayment period between 10 20 years attached. To see this view click on show.

A home equity line of credit or HELOC ˈ h iː ˌ l ɒ k HEE-lok is a loan in which the lender agrees to lend a maximum amount within an agreed period called a term where the collateral is the borrowers equity in their house akin to a second mortgageBecause a home often is a consumers most valuable asset many homeowners use home equity credit lines only for. Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal. Available Credit Withdraw funds Make a payment.

HELOC Payments How are HELOC repayments structured. Equity loans typically charge a slightly higher initial rate than HELOC do but they are fixed loans rather than adjustable loans. The monthly interest rate is calculated via a formula but the rate can also be input manually if needed ie.

Most personal loans fund a lump sum amount upfront and require you to pay it back with monthly payments over a set period of. All closing credits paid by APFCU must be reimbursed if the loan is closed before. With a Bank of America HELOC there are no closing costs no application fees no annual fees and no fees to use the funds.

What Is A Heloc And How Does It Work Rodgers Associates

What Is A Heloc And How Does It Work Rodgers Associates

Heloc Rates And Loans In Oregon Wafd Bank

Heloc Loan Calculator Clearance 51 Off Www Ingeniovirtual Com

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Heloc Rates And Loans In Oregon Wafd Bank

Home Equity Line Of Credit Heloc Uccu

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

How A Heloc Works Tap Your Home Equity For Cash

Home Equity Line Of Credit Heloc Rocket Mortgage

The Best Heloc Rates Loans Guide What Is A Heloc How Does It Work Advisoryhq

Heloc Calculator

What Is A Heloc And How Does It Work

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Payment Calculator With Interest Only And Pi Calculations

How A Heloc Works Tap Your Home Equity For Cash